“Informational technology, oral and written communication, self-management, global awareness and financial literacy are the five critical skills that young women need in the twenty-first century,” began Jody Hoff, Senior District Manager in the Community Engagement Group at the Federal Reserve Bank of San Francisco (FRBSF). “Only a third of the economists who hold Ph.Ds are women. It is imperative to have good financial literacy skills for a successful future.”

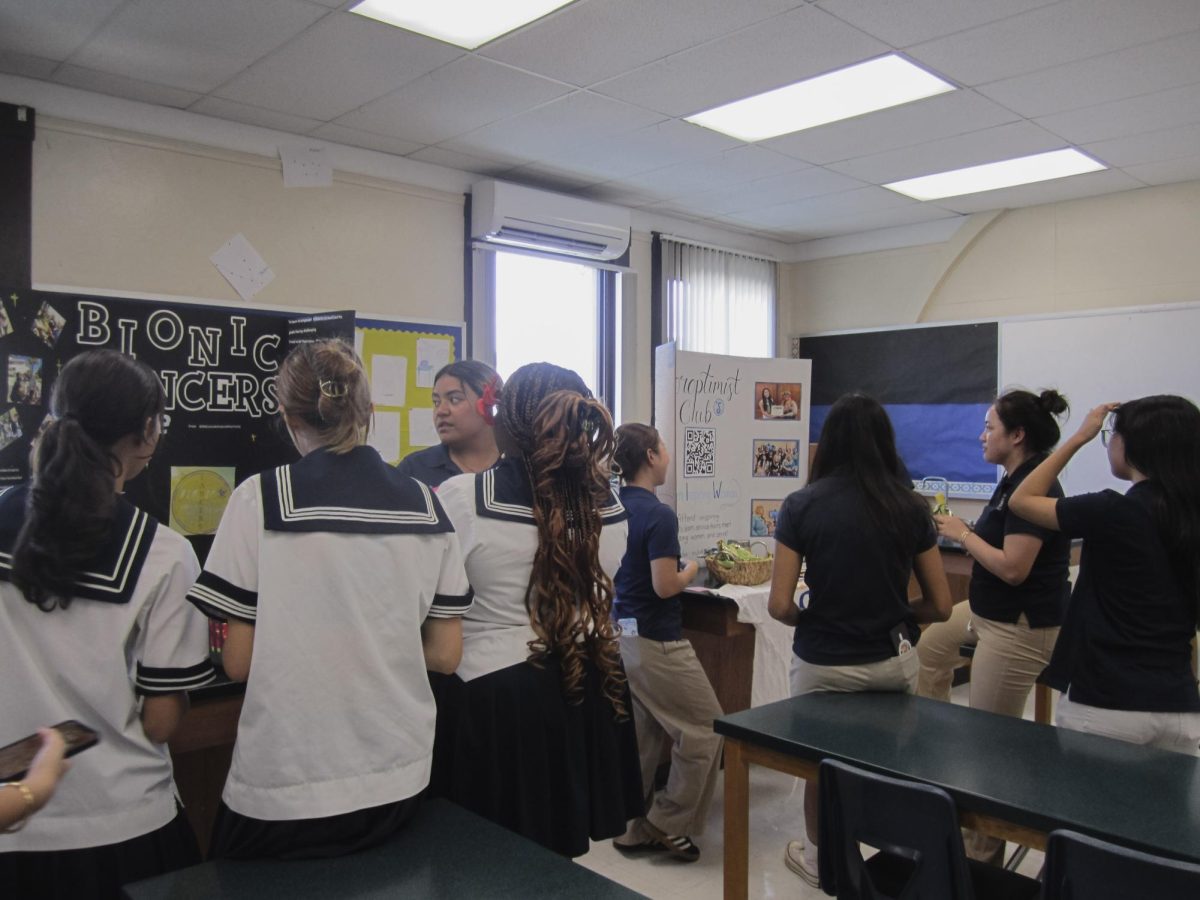

With support from the National Coalition of Girls’ Schools (NCGS) and in response to the recent appointment of Janet Yellen as Chair of the Federal Reserve System, Sacred Hearts Academy hosted an all-day workshop for sophomores, juniors and seniors, featuring three members of the FRBSF and local entrepreneurs, Susan Yamada, Lauren Ellis and Kimo Carvalho, in the Personal Finance Education Day on Mar.18.

According to Social Studies department chair, Lurline Choy, “This was a once-in-a-lifetime opportunity, basically. The Fed has not been here since 1992. This was the first time it spoke to high school students here in Hawaii. The purpose of the Fed’s arrival in Hawaii is the financial well-being of females. What has happened over time is that females tend to be less and less financially astute. It has always been a man’s world, especially in the banking industry.”

Sacred Hearts has the honor of being the first high school for a FRBSF visit. Members of the FRBSF last visited Hawaii to speak to students in the University of Hawaii’s Shidler College of Business.

Students from La Pietra and Saint Andrew’s Priory joined Academy students for the day.

Local entrepreneurs included Susan Yamada, founding CEO of TRUSTe and Executive Director of the Pacific Asian Center for Entrepreneurship (PACE) at the Shidler College of Business; Lauren Ellis, founder and lead wedding coordinator at Aloha Bridal Connections; and Kimo Carvalho, Chairman of the Board at Envision Hawaii and Development and Community Relations Manager at the Institute for Human Services (IHS).

“We try to cover personal finance in the regular Economics class here, but we can only cover so much because it is a college prep class. Students have learned how to deal with credit cards and balancing a checkbook as well as buying a car and things of that sort, but it’s different when students actually go out into the world,” said Choy. “The Feds explained to students the purpose of setting goals and committing themselves to setting a simple budget which was great since we try to offer that in class, but it’s never enough.”

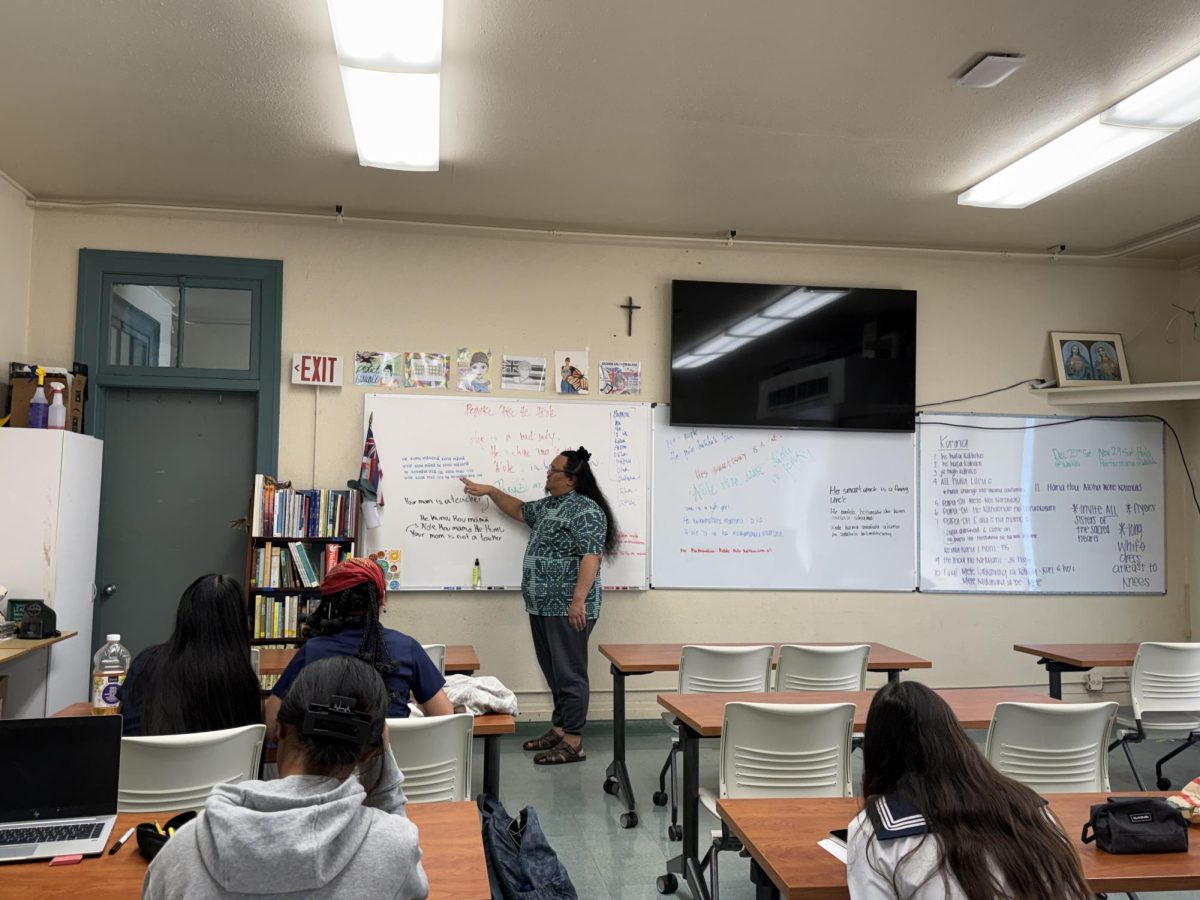

Personal Finance Education Day featured three hour-long sessions for each division and an entrepreneurial leadership panel discussion with a question-answer segment.

Lorraine Thayer, District Assistant Manager of Economic Education at FRBSF, spearheaded the Personal Finance Workshop which stressed the creation of a budget as well as dealing with investments and rates of return.

“You need to be proactive instead of being reactive with your money. Have a budget,” said Thayer. “Manage your money. Do not let it manage you.”

Thayer briefed students on creating a simple budget, a system composed of three steps.

“First, total up your income and then your expenses,” she said. “Finally, find the difference. You want to be in the black and not in the red.”

“I found this workshop to be extremely valuable for me since I will be graduating soon and headed to college,” said senior Nicole Faima. “I could not figure a way to budget while in college, but thanks to what I have learned in this workshop, I plan on setting a simple budget and sticking to it.”

“Our job is to promote the safety, soundness and stability of our nation’s financial system,” said Hoff. “The Fed deals with creating high employment and stable prices in the economy.”

Hoff’s session, “Purposes and Functions of the Fed,” focused on explaining the jobs of the Federal Reserve and its unique structure and giving students the opportunity of being in charge of monetary policy at the Fed through a simulated game.

“I was surprised by two things that I learned in this session. One was that [the Board’s] governors are appointed to a long term of 14 years. I was shocked because that term is longer than that of the president,” said sophomore Lindsey Ogata. “The second thing was that the Fed is decentralized and independent from the government. I always thought that the Fed needed permission from Congress to carry out its jobs.”

Rema Oxandaboure, Outreach and Social Media Specialist in Economic Education at the Los Angeles Branch of the FRBSF, highlighted the importance of beginning early in the search for scholarships to finance college.

“How to Finance College” began with a short video from Yale student, Joel Bervell, who searched for and accumulated over $200,000 in scholarship money and encouraged students to search everywhere for scholarships.

“An important part of scholarship process is tailoring each application to the organization or group giving the scholarship,” said Oxandaboure. “Find out what you’re passionate about and talk about it. Have your elevator pitch ready!”

“I did not apply to too many scholarships, but for the ones that I did, I had to tweak some of my recyclable essays to make it more applicable to the organization’s mission or goals,” said senior Dominique Dold. “What I did not realize was that I had actually already prepared an elevator pitch when I spoke to relatives about my future plans. It is valuable knowing that an elevator pitch is useful in interviews as well!”

“I wish I had known what the students learned today while I was a junior and senior in high school because I took out a lot of loans in college which I am still paying today. If I had known this in high school, I would not be in as much debt as I am right now,” said social studies teacher, Aimee Paa. “Students are lucky because there is the Internet to research scholarships.”

“The information during this session was really valuable. As juniors, my class will be applying for scholarships soon and it was extremely helpful to receive advice from people who have recently experienced the process,” said junior Tiffany Nakama-Fukuhara. “I think I will be willing to apply for anything that will offer me a significant amount of money to use for college.”

The afternoon panel discussion illuminated aspects of business and industry and the necessary skills for today. Panelists encouraged students to develop ideas to create changes in their communities. In the question-answer segment, panelists were asked questions ranging from life skills needed for the future to things that the Fed panelists would have done in high school.

“For me, it would have to be taking more risks,” said Megan Murphy, Executive Director of NCGS. “I would have started a club or done something outside my comfort zone. I definitely would have grabbed more opportunities.”

Ellis’ advice for young women was simple.

“It is important for you to think about the lifestyle that you want to live in the future,” she said. “Be fearless in your endeavors and expect a lot from yourself. Keep setting goals and raising your standards.”